Pedestrians walking past a Tesla store in Shanghai, China, on March 14, 2024.

CostFoto | Nurphoto | Getty Images

Tesla shares sank in premarket trading on Monday, while China’s Li Auto plummeted to an 11-month low, after both companies slashed prices of their electric vehicles in various markets amid intense competition.

U.S. EV giant Tesla cut the starting price of its Model 3 in China to 231,900 yuan ($32,000) on Sunday, a reduction of 14,000 yuan, as reported by Reuters. The report also said it had slashed prices in other major markets, like Germany.

Meanwhile, Li Auto cut prices for its models, including the L7, L8, L9, and the newly launched MEGA SUV, it said on its Weibo account on Monday. The cuts for the models were reportedly up to 30,000 yuan.

Checks by CNBC of both Tesla and Li Auto websites on Monday showed their vehicles were listed at the updated prices.

Hong Kong-listed shares of Li Auto fell 8.3% to their lowest level in 11 months during the Monday session, while shares of other Chinese EV makers also fell — Nio was down 1.7%, Xpeng off 1.9% and BYD down 0.2%.

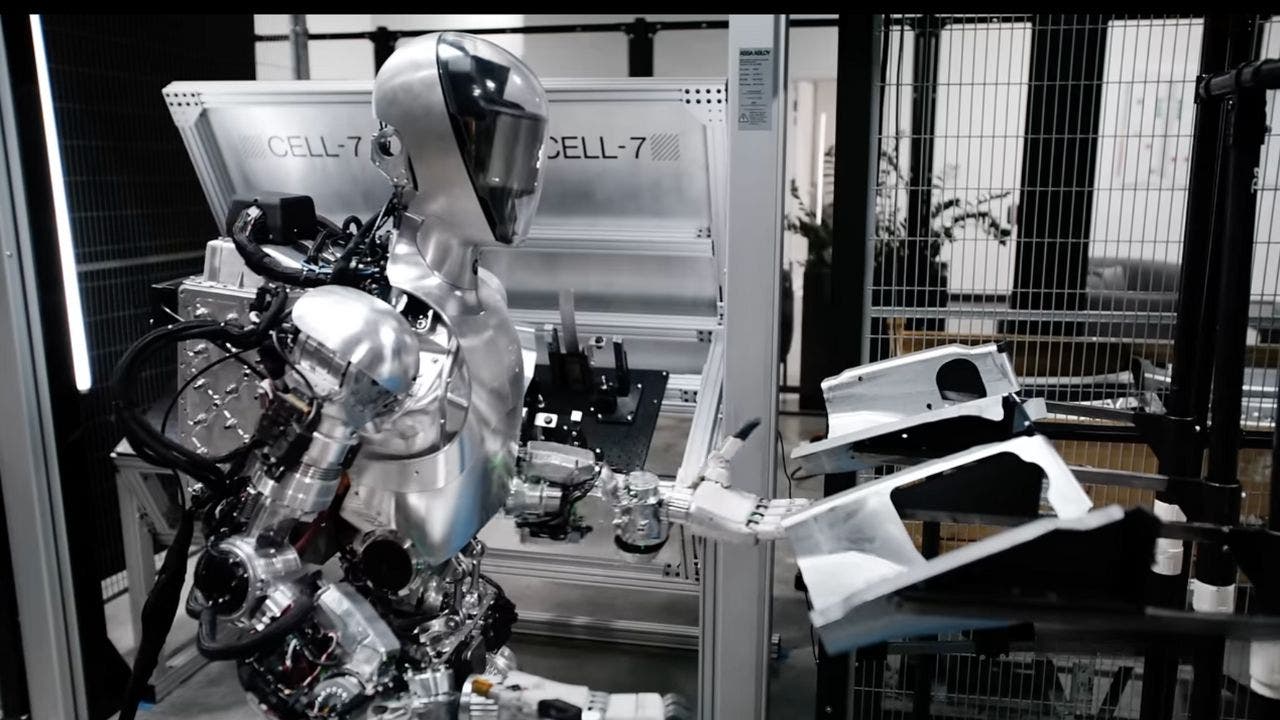

These price reductions come at a time when competition in China’s EV space has intensified, with local automakers pushing to outsell U.S. rival Tesla with fancy tech and competitive pricing.

Eugene Hsiao, head of China equity strategy at Macquarie Group, said in a research note over the weekend that all of China’s biggest EV makers have one goal in mind — “taking the crown from Tesla,” while noting that it is the most competitive domestic auto market in recent history.

Hsiao said the price discounts were just one facet of a variety of strategies that big EV players in China are using to survive “the coming wave of industry consolidation.”

Chinese smartphone maker Xiaomi launched its SU7 electric car earlier this month and priced it at about $4,000 less than Tesla’s Model 3. The company also claimed the new car would have a longer driving range.