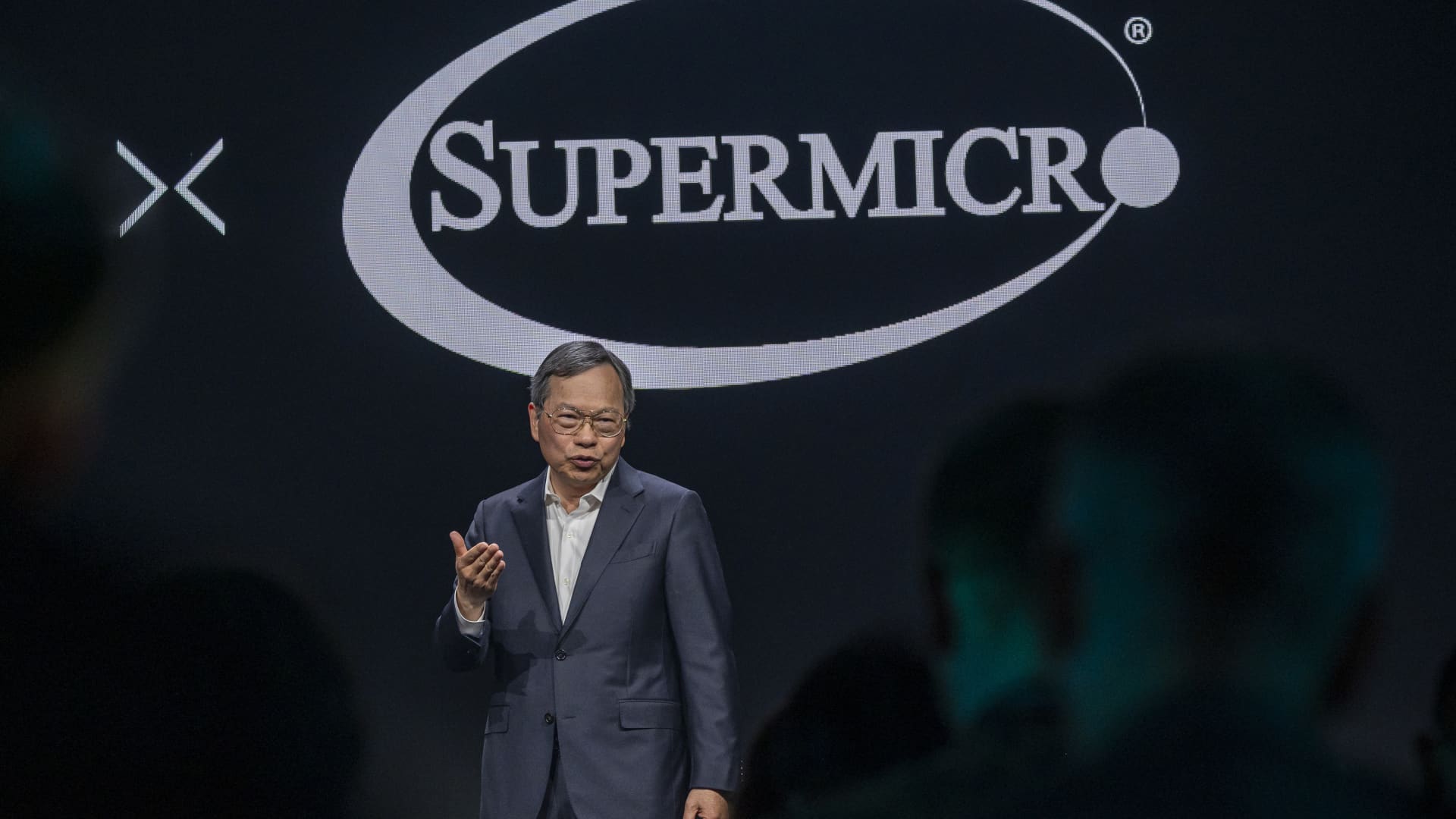

Charles Liang, CEO of Super Micro Computer, during the AMD Advancing AI event in San Jose, California, on Dec. 6, 2023.

David Paul Morris | Bloomberg | Getty Images

Shares of Super Micro Computer tumbled more than 23% on Wednesday, after the company announced it would not file its annual report for the fiscal year with the U.S. Securities and Exchange Commission on time.

“SMCI is unable to file its Annual Report within the prescribed time period without unreasonable effort or expense,” the company said in a release. “Additional time is needed for SMCI’s management to complete its assessment of the design and operating effectiveness of its internal controls over financial reporting as of June 30, 2024.”

Super Micro makes computers that companies use as servers for websites, data storage and other applications, including artificial intelligence algorithms. The company’s customers include major players in AI, including Nvidia, AMD and Intel.

The stock is up more than 47% year to date, but investors were spooked on Tuesday after Hindenburg Research disclosed a short position in the company. Hindenburg said it identified “fresh evidence of accounting manipulation,” according to its report. CNBC could not independently verify Hindenburg’s claims. It is unclear if the delay in Super Micro’s annual report is related to Hindenburg’s findings.

Analysts at JPMorgan said some of Hindenburg’s claims are “tough to verify,” and they think the report is “largely void of details around alleged wrong doings from the company.”

Even so, the analysts said Super Micro still has room for improvement when it comes to communicating with investors and establishing clear governance and transparency, especially since it has grown so rapidly due to demand for its AI servers.

“As we dig into the details of the report, we believe there to be limited evidence of accounting mistreatments beyond revisiting the 2020 charges from the SEC, and limited new information relative to the existing and already known business relationship with related companies owned by the siblings of the founder of SMCI,” the analysts wrote in a Tuesday note.

— CNBC’s Michael Bloom contributed to this report.