SoftBank’s Vision Fund, the brainchild of the company’s founder Masayoshi Son, has faced a number of headwinds including a slump in technology stocks as a result of rising interest rates, a tough China market and geopolitics.

Kentaro Takahash | Bloomberg | Getty Images

SoftBank posted a 7.24 billion Japanese yen ($4.6 billion) gain on its Vision Fund in the fiscal year ended March, the first time the flagship tech investment arm has been in the black since 2021.

SoftBank’s flagship tech investment arm, the Vision Fund, had a tough time in the fiscal year that ended in March 2023, posting a record loss of around $32 billion amid a slump in tech stock prices and the souring of some of the business’ bets in China.

However, in the June quarter of last year, the Vision Fund posted its first investment gain in five consecutive quarters, signalling early stages of a recovery.

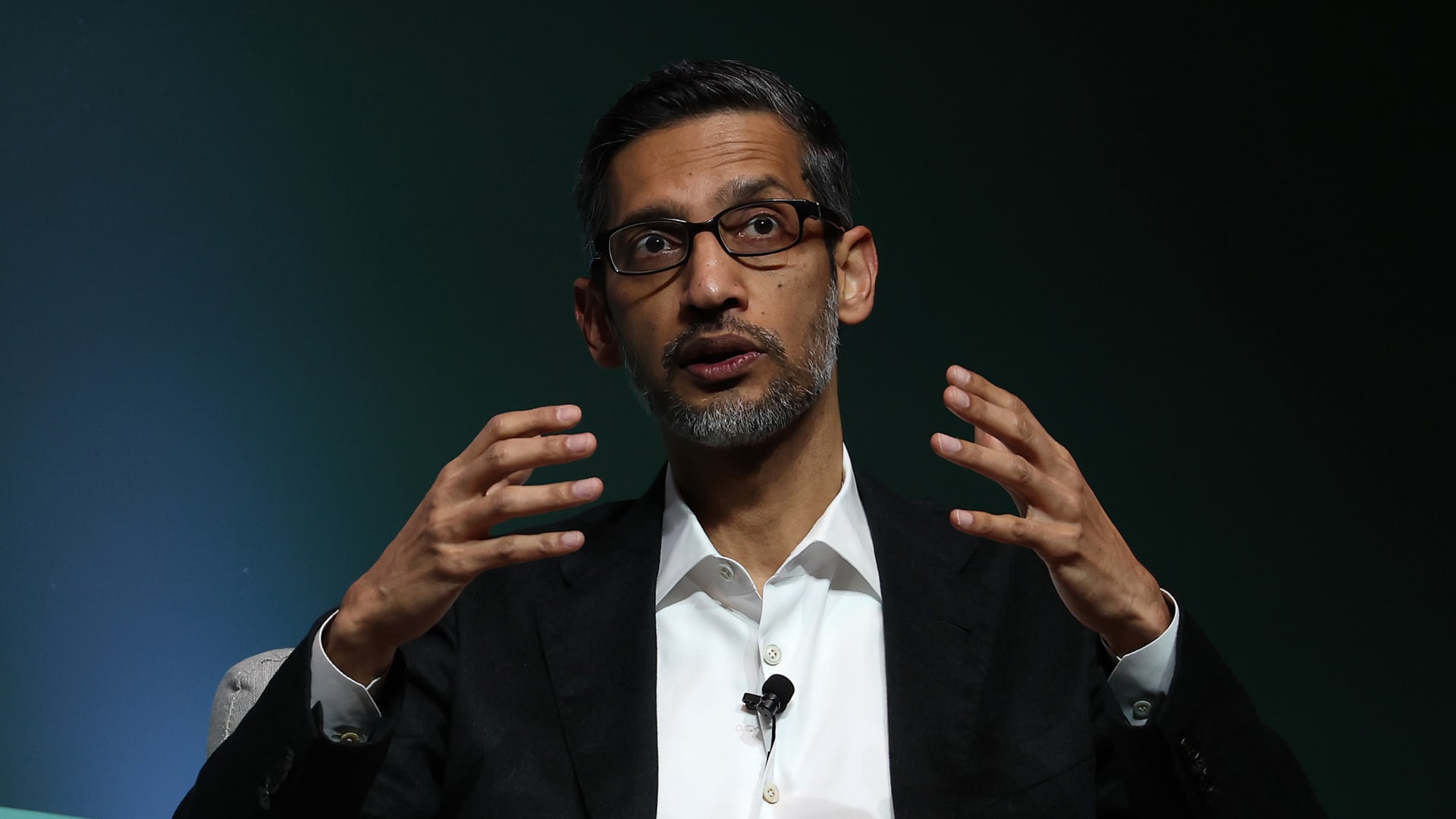

SoftBank founder Masayoshi Son flagged in 2023 that the firm would shift into “offense” mode, from defense mode, and depart from its cautious approach to start making more investments.

SoftBank’s Chief Financial Officer Yoshimitsu Goto said in the previous quarter that SoftBank had shifted from an “Alibaba to AI-centric portfolio.”

The tech conglomerate grew into one of Japan’s biggest companies thanks to Son’s early bet on Chinese e-commerce giant Alibaba in 2000, which has boomed over the coming years.

The firm has been cutting its stake in Alibaba, and senior executives, including Son and Goto, have touted their excitement around artificial intelligence technology and the SoftBank’s potential to invest in companies in the sector.

This breaking news story is being updated.