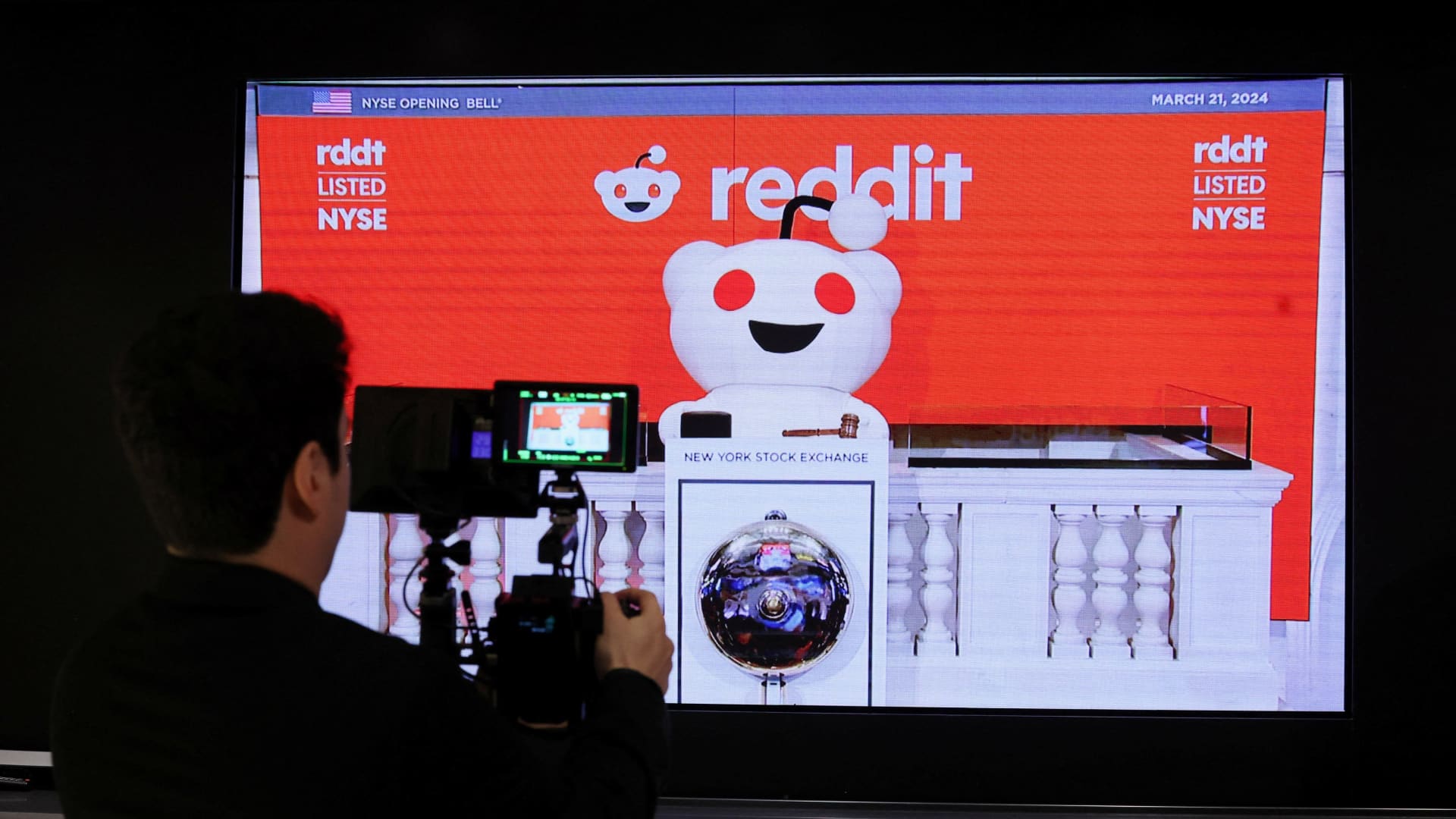

Reddit CEO Steve Huffman hugs mascot Snoo as Reddit begins trading on the New York Stock Exchange (NYSE) in New York on March 21, 2024.

Timothy A. Clary | AFP | Getty Images

Reddit shares were up 30% to $59.80 at the market’s close on Monday.

The social media company’s stock has been rising ever since it went public last week and raised roughly $750 million from the IPO, of which the company logged about $519 million.

Reddit shares soared 48% when it began trading on the New York Stock Exchange under the stock ticker “RDDT,” resulting in a number of moderators and users, known as Redditors, earning millions of dollars as a group. Those Redditers, along with corporate insiders and their friends and family members, were able to partake in Reddit’s IPO via a directed-share program, akin to similar offerings by tech companies like Airbnb, Rivian and Doximity.

OpenAI CEO Sam Altman, who was a Reddit investor and a former board member, saw his stake in the company grow from $200 million to over $613 million via the IPO.

Reddit’s IPO came the same week that Astera Labs shares skyrocketed 72% on the day that the data center hardware company made its public market debut on the Nasdaq. Reddit was the first major social media company to have gone public since Pinterest’s IPO in 2019, and investors were monitoring its stock debut to gauge whether the IPO market might pick up after a long lull due to factors like high inflation, poor market responses to several 2023 IPOs and concerns over the wider global economy.

Plexo Capital founding managing partner and Reddit shareholder Lo Toney told CNBC that Reddit’s IPO was “a positive sign not only for Reddit, but I think also the tech industry and what it might mean for future IPOs.”

“One thing we know with certainty is that there are a lot of investor appetite during the roadshow for Reddit and we see that it’s continuing to hold up well,” Toney said. “Clearly the market is signaling there’s an appetite for more companies to come to the public markets.”

Still, Toney said that there are other “dynamics that need to happen,” including a few more companies entering the public market before it’s safe to say that the IPO floodgates have opened. Toney noted that some startups have raised a lot of money so they may not be in any hurry to go public and raise more cash.

“At the same time there are instances where the last private market financing may be higher than what the public market will accept as a public company valuation,” Toney said, adding that some startups with high private valuations may still have concerns about going public at a lower valuation.

Reddit had a private market valuation of $10 billion in 2021 when it last raised a funding round, according to deal-tracking service Pitchbook, and was valued at roughly $6.5 billion based on its IPO price of $34 per share.

Watch: IPO window opening remains to be seen despite strong Reddit IPO.