There’s a reason business scams are so pervasive. Criminals are looking for the most bang (money) for their buck (effort). That’s why it shouldn’t surprise any of us that homeowners are a new target.

I’m giving away a $1,000 gift card to your favorite airline.

So much of the home-buying process is going digital, and that means moving around large sums of money. Scammers have found their way in, targeting both homeowners and those buying and selling.

POLICE WARN HOMEOWNERS OF ‘OUT OF TOWN’ SCAMMERS TRYING TO SELL, RENT VACATION PROPERTIES THEY DON’T OWN

It can happen to anyone

A Minnesota woman recently received a shocking phone call about her husband’s dirty financial affairs. He had an unpaid loan from years ago, and the caller told her they were putting a lien against their home.

The mystery caller gave the woman a case number and a phone number to call for more details. She did, and got even more details about the supposed loan.

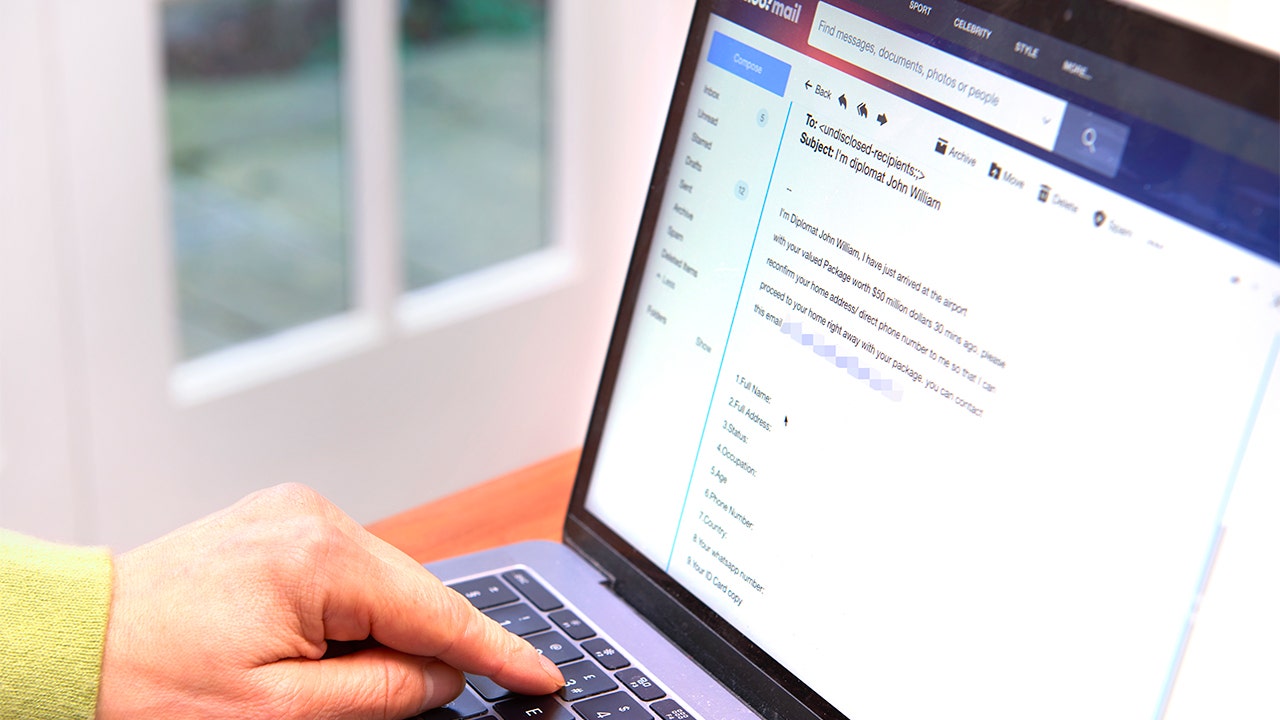

Scammers are using fake liens and other devious means of conning homeowners, buyers and sellers out of their money. (Feverpitched/iStock)

Her husband was adamant he never took out a loan, though. Luckily, this woman was smart. She called her county recorder, who said there was nothing on record against their property.

It was all a scam, and homeowners across the U.S. are falling victim.

Who’s a target?

If you own a home, you’re a target. Plain and simple.

One of real estate scammers’ favorite tricks is to scare victims into thinking they owe money. The only way to keep their property? Pay up right now!

YOUR CAR IS A TARGET — DON’T GET HACKED OR DUPED

Lenders will secure loans with liens that give them a claim to your property if you don’t make payments. But the good news is there’s always a paper trail. (I share how to find that below.)

Scammers also target homeowners at risk of foreclosure. They’ll reach out with promises to save the day if the victims can just fork over some cash. They may even call up homeowners and convince them to refinance their homes.

Buying a home?

Crooks are out for you, too. They’ll create fake real estate listings and trick you into paying a deposit. They may pose as an escrow company and ask you to wire money.

This just happened to a New Jersey couple who were duped out of $32,500 in the process of buying their dream home. Scammers faked an entire email thread with their lawyer, the seller’s lawyer and the real estate agent. The couple wired the down payment, their savings, to crooks.

Scammers aren’t above faking entire email conversations to get what they want out of you. (Photo by Peter Dazeley/Getty Images)

If you’re wondering how anyone could fall for this, it was incredibly easy. The scam email addresses were one letter off from the real ones.

The lesson here: Always, always triple-check email addresses to make sure they match the rest of your correspondence.

Sign up for free notification alerts

The best way to protect yourself from property fraud is to be proactive. Some counties offer free alerts via email, voicemail or text when a land document (like a deed) gets recorded with your name on it.

10 VOICE SCAMS TO WATCH OUT FOR – AND YOUR QUICK ACTION PLAN

Unfortunately, there isn’t a comprehensive centralized directory to find the service for any county, but you have a few options:

- First, check this website to see if your county has a partnership for free alerts.

- Your county may offer alerts through its own service. Search “[your county name] + county recorder” or “[your county name] + county recorder of deeds” to find your county’s official .gov site. Then, type “property fraud alerts” in the site’s search bar to avoid scam links.

- If you still haven’t heard anything, your best bet is to call the county recorder directly. Their official site should list a contact number.

Have a friend thinking about buying or selling a home? Don’t let them be a victim. Share this story to keep them safe!

CLICK HERE TO GET THE FOX NEWS APP

Get tech-smarter on your schedule

Award-winning host Kim Komando is your secret weapon for navigating tech.

Copyright 2024, WestStar Multimedia Entertainment. All rights reserved.