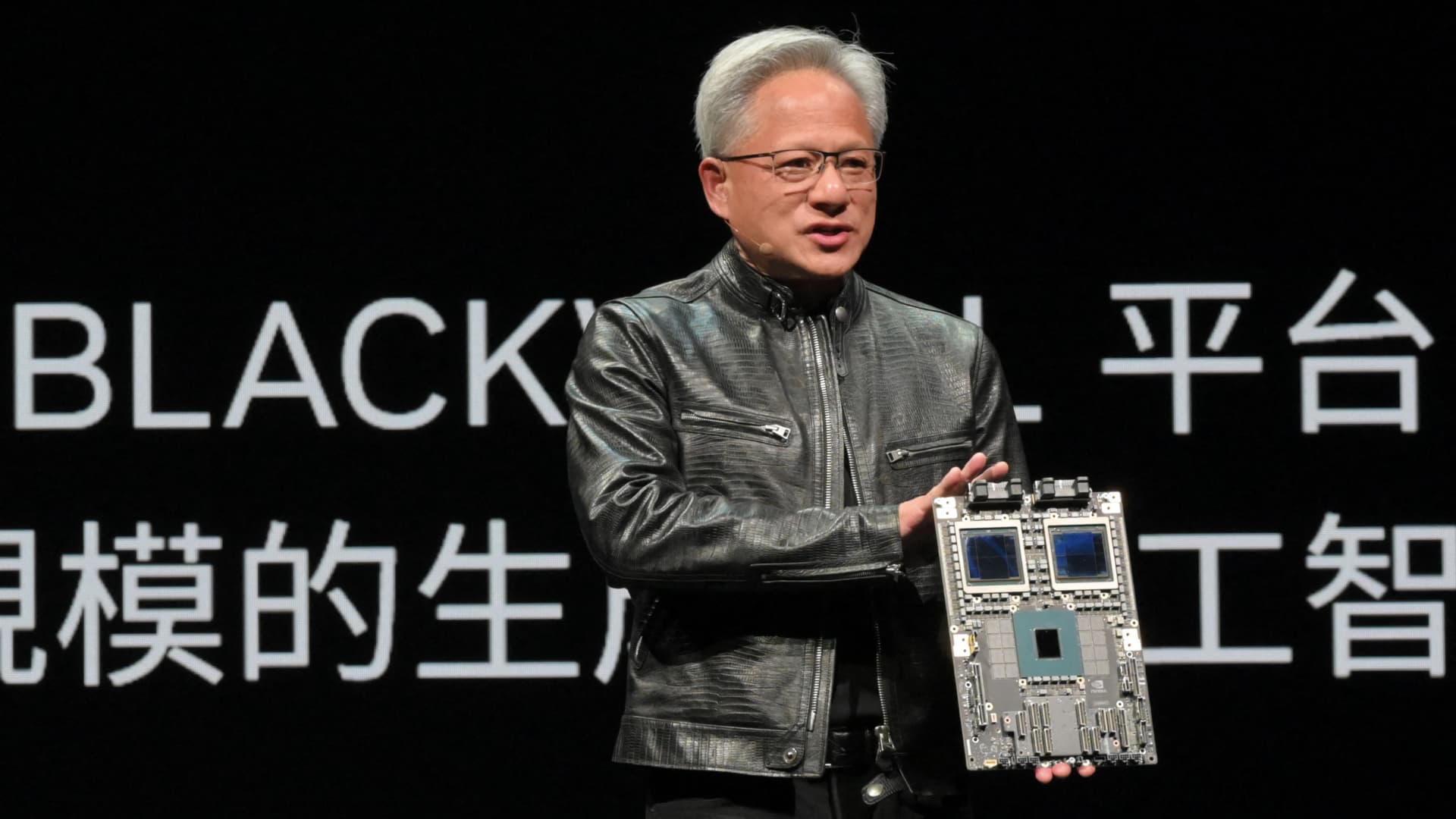

Nvidia’s CEO Jensen Huang delivers his keystone speech ahead of Computex 2024 in Taipei on June 2, 2024.

Sam Yeh | AFP | Getty Images

Nvidia briefly surpassed $3 trillion in market cap during intraday trading on Wednesday as investors continue to clamor for the company making most of the chips powering the AI boom.

Nvidia shares were up more than 4% to $1,219 at one point during intraday trading on Wednesday before falling. Nvidia also momentarily passed Apple as the second largest U.S. company.

Nvidia’s milestone is the latest stunning mark in a run where the stock price has gone parabolic as investors bet on artificial intelligence. Shares are up over 3,224% over the last five years. It will split its stock 10-1 later this month.

Apple was the first U.S. company to reach a $3 trillion market cap during intraday trading in January 2022. Microsoft hit $3 trillion in market value in January 2024. Nvidia, which was founded in 1993, passed the $2 trillion valuation in February, and it only took roughly three months after that for it to claim the $3 trillion milestone.

In May, Nvidia reported first-quarter earnings that suggested demand for the company’s pricey and powerful AI chips, often called GPUs, showed no sign of slowing down. Nvidia reported overall sales of $26 billion, more than triple what the company reported a year ago. Nvidia also beat Wall Street expectations for sales and earnings and said it would report revenue of about $28 billion in the current quarter.

Nvidia shares have surged in recent years, powered by the tech industry’s need for its chips, which are used to develop and deploy big artificial intelligence models like the one at the heart of OpenAI’s ChatGPT.

Companies such as Google, Microsoft, Meta, Amazon and OpenAI are buying billions of dollars of Nvidia’s graphics processing units.