Nigerians affected by the rising cost of living obtained credit facilities worth N3.82tn from banks as of January 2024, the Central Bank of Nigeria has stated.

An analysis of the latest monthly economic report posted on its website revealed that the total consumer credit rose by 11.9 per cent to N3.82tn in January 2024, driven, mainly, by the rise in personal loans on the back of heightened inflation.

On a year-on-year basis, the figure represented an increase of N1.41tn from N2.41tn recorded in January 2023.

It added that personal loans increased by 14.3 per cent to N3.028tn from N2.648tn in December 2023, while retail loans rose by 3.6 per cent to N794.79bn.

Personal loans also accounted for 79.2 per cent of consumer credit, while retail loans accounted for 20.8 per cent highlighting Nigerians’ struggle with unwavering inflation and waning purchasing power.

The report read, “Total consumer credit outstanding increased by 11.9 per cent to N3.82tn in January 2024, driven, mainly, by the rise in personal loans on the back of heightened inflation. A disaggregation of consumer credit revealed that personal loans increased by 14.3 per cent to N3.028tn from N2.648tn in December 2023, while retail loans rose by 3.6 per cent to N794.79bn. Personal loans accounted for 79.2 per cent of consumer credit, while retail loans accounted for 20.8 per cent. Consumer credit, as a share of total credit from ODCs, however, declined to 6.6 per cent, from 7.7 per cent in the preceding month.”

The apex bank further stated that total credit extended to key sectors of the economy increased by N13.22bn or 29.7 per cent to N57.76bn, compared with N44.54bn in the preceding month.

“Total credit extended to key sectors of the economy by other depository corporations increased by 29.7 per cent to N57.76bn, compared with N44.536bn in the preceding month. The growth was driven by the sustained increase in credit to services (25.6 per cent), industry (37.5 per cent), and agricultural sector (7.1 per cent). A decomposition of sectoral credit indicated that the services sector remained dominant, accounting for 52.1 per cent. Industry constituted 44.7 per cent, while agriculture accounted for the balance of 3.2 per cent,” the report added.

The headline inflation rate reached a 28-year high of 33.95 per cent in May forcing the apex bank to hike the interest rate consecutively to 26.25 per cent.

Nigerians have found themselves grappling with deteriorating living standards and increased economic hardships after the implementation of sweeping economic reforms by the current administration.

As a result, the country is facing its worst economic crisis in decades, with skyrocketing inflation, a national currency in free fall and millions of people struggling to buy food.

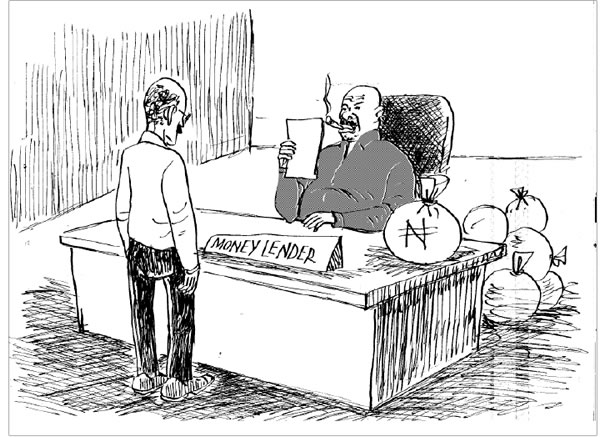

This situation has forced many citizens to seek loans as an alternative to meet their basic needs.

A study by SBM Intelligence found that 27 per cent of Nigerians across different income categories now resort to loan apps to keep up with their living expenses in the wake of record inflation.

The surge in demand for these loan apps is indicative of the severe impact of the unyielding inflationary pressures on the daily lives of Nigerians, especially those already grappling with limited financial resources.

While citizens in the informal sector patronise loan apps, civil servants turn to their employers for succour.

Meanwhile, public servants obtained credit facilities worth N6.1bn from their respective state governments within 15 months amid worsening economic hardship.

The borrowing obtained as loans and salary advances were granted to the civil servants between January 2023 and March 2024, according to an analysis of their budget implementation report obtained from the Open States website.

Further analysis showed that the workers obtained loans from 11 states to buy motor vehicles and build homes and furniture.

Our correspondent also observed that most states didn’t disburse the loans to their workers despite the budgetary allocation of their annual budget breakdown showed that civil servants in Delta State got the highest loan of N2.75bn, followed by Kano State with N1.1bn and Kebbi State with N680m.

Fourth on the list is Yobe State with salary advances worth N586.88m.

Other states including Lagos State lent N294.44m, Jigawa N244.58m, Enugu (N401.94m), Anambra (N427,200), Borno (N428,000), Kwara (N44.13m), Ogun (N8.16m).

Founders of loan companies have stated that harsh economic realities have forced more individuals to rely on more loans because of the constant rise in the cost of goods and services, especially since the removal of fuel subsidies.

In an interview with The PUNCH, the Chief Executive Officer/founder of Trade Lenda, Adeshina Adewumi, said his firm’s absolute numbers had grown by 100 per cent in recent times.

He said, “The numbers have gone quite high. In terms of users, we have grown slightly over 100 per cent within this subsidy removal period, June and July.

“The increase in loans is generally across the board even though we do not focus on individuals. We focus just on businesses that need loans to grow their business, and we have seen the number grow significantly high. We have grown by over 100 per cent in the last two months. People are requesting N50,000 (the least we have seen) and as high as N5m.”

The founder of TellerOne, Olajuwon Marc, affirmed that the number of approved loans by his company had grown.

He stated that in recent times, the economy has stifled businesses and the only way they could grow was to borrow more.

He said, “Things are now very expensive and the initial capital businesses have is no longer enough to buy things from the market, and they now rely on loans to survive this. We give out these loans to SMEs.”

He added, “The number of approved loans has grown to up to 70 per cent. The demand has surged to over 100 per cent. People always need loans, and the harsh economic realities now are driving this.”

While loan apps are offering a reprieve to small businesses, there are still plenty of issues that only serious government action can solve.