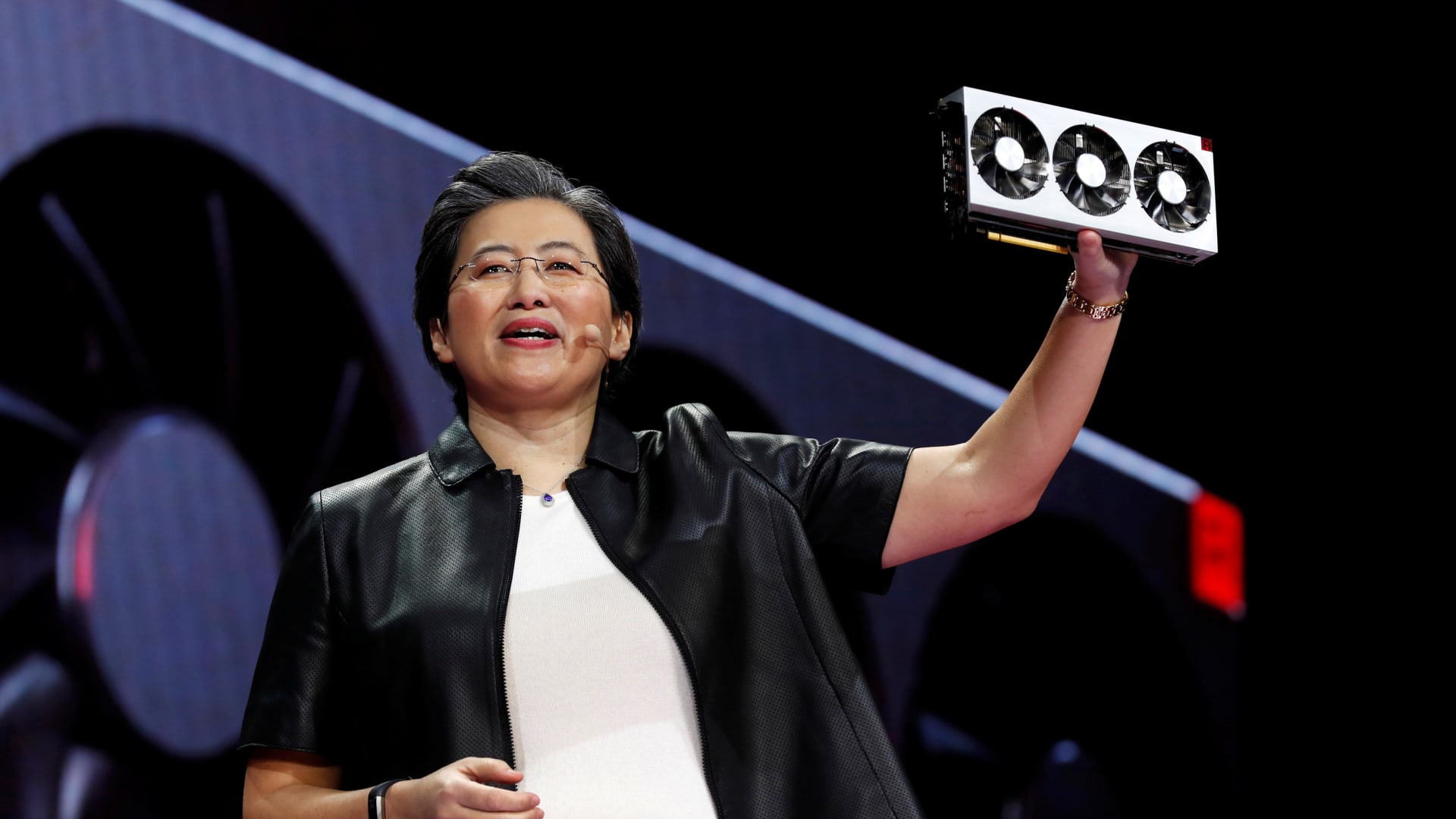

Lisa Su, president and CEO of AMD, talks about the AMD EPYC processor during a keynote address at the 2019 CES in Las Vegas, Nevada, U.S., January 9, 2019.

Steve Marcus | Reuters

AMD reported first-quarter sales on Tuesday that were slightly ahead of Wall Street expectations, and provided an in-line forecast for the current quarter.

AMD shares dropped over 3% in extended trading.

Here’s how it did versus LSEG consensus expectations for the quarter ending in March:

- Earnings per share: 62 cents adjusted. That doesn’t compare to expectations of 61 cents.

- Revenue: $5.47 billion vs. $5.46 billion expected.

AMD said it expects about $5.7 billion in sales in the current quarter, in-line Wall Street estimates of about $5.70 billion. That would represent about 6% annual growth.

The company reported net income of $123 million, or 7 cents per share, versus a net loss of $139 million, or 9 cents per share, during the year-earlier period. Revenue was up about 2% from a year earlier. The company’s adjusted earnings didn’t compare to analyst forecasts because AMD had added a new item for inventory loss.

AMD said its closely-watched Data Center segment grew 80% on a year-over-year basis to $2.3 billion thanks to sales of its MI300 AI chip, which competes with Nvidia’s AI graphics processors. AMD said it had sold over $1 billion of the AI chips since it launched in the fourth quarter of 2023. AMD officials will likely provide an update about MI300 sales during an earnings call with analysts.

AMD’s weakest division was its gaming segment, which was down 48% on an annual basis to $922 million, which the company said was due to lower chip sales for game consoles and PCs.

AMD’s original business, processors for chips and PCs, is reported as client segment revenue. AMD reported $1.4 billion in first-quarter sales, a 85% annual increase, suggesting that last year’s PC slump is over. AMD is also highlighting its chips being able to run artificial intelligence programs locally, which would allow it to power so-called “AI PCs” that many industry participants are banking on to drive new laptop and desktop sales.

The company’s embedded segment, made up of products acquired as part of the Xilinx acquisition in 2022, reported falling sales, dropping 46% on an annual basis to $846 million.

This story is developing. Please check back for updates.