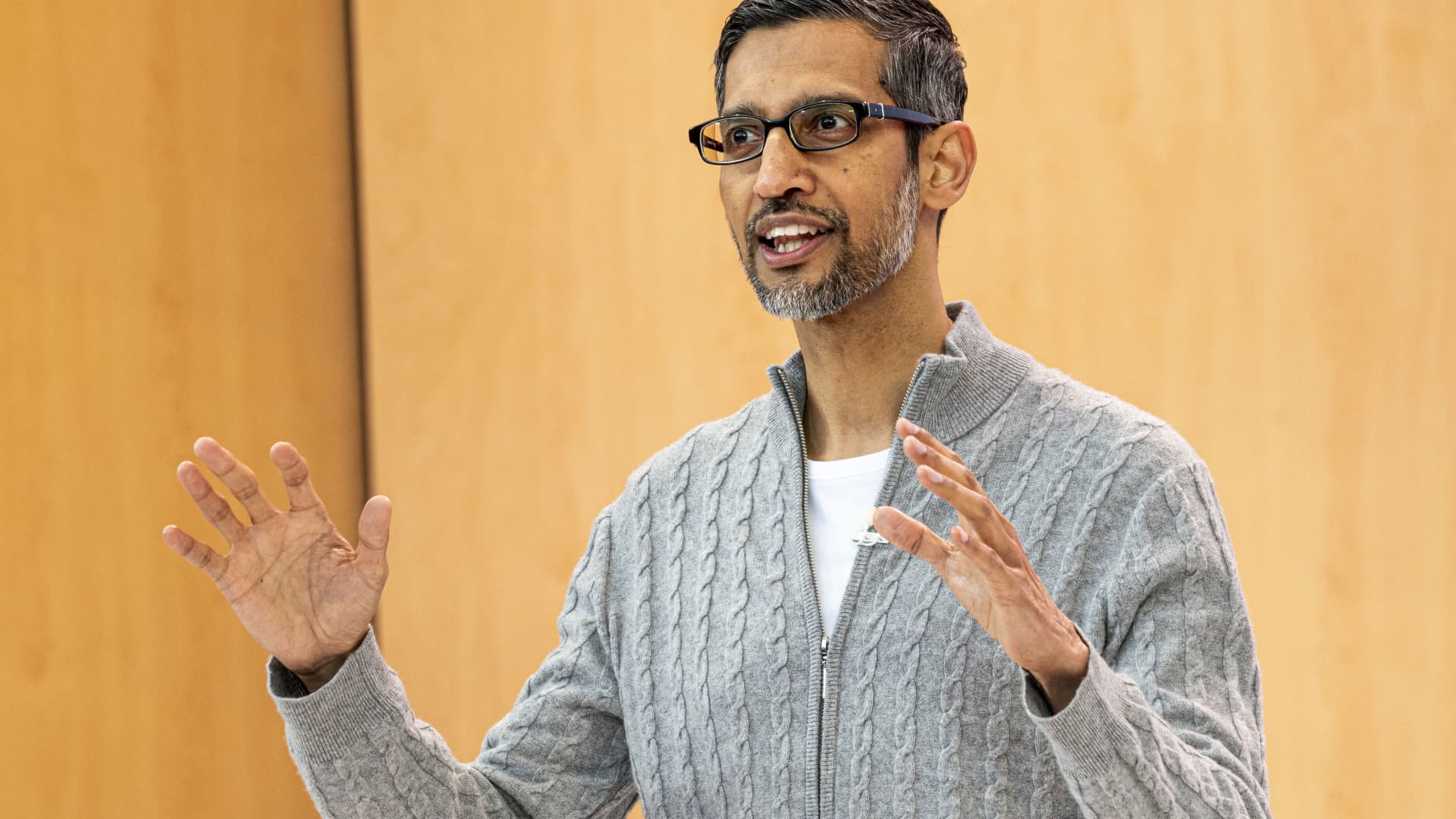

Google and Alphabet CEO Sundar Pichai departs federal court on October 30, 2023 in Washington, DC. Pichai testified on Monday to defend his company in the largest antitrust case since the 1990s.

Drew Angerer | Getty Images News | Getty Images

Alphabet’s board said Thursday the company would issue a 20 cent per share dividend, the company’s first ever, and had authorized the repurchase of up to $70 billion shares.

The company’s move comes after Meta’s board authorized its first ever dividend in February. Google’s parent company had $108 billion in cash and marketable securities on hand as of March 31, 2024.

Shares shot up 12% on the news, which was announced alongside better-than-expected first quarter earnings.

Alphabet authorized an identically-sized repurchase exactly one year ago, during a period of intense cost-cutting and layoffs.

The dividend is payable to all class of shares, including super-voting Class B shareholders, as well as non-voting Class C shareholders. Most Google investors own the company through Class A shares. All shareholders of record as of June 10 will receive the dividend the same month.

Co-founder Sergey Brin, who owns more than 730 million Class B and C shares, will receive a $146 million payout. Co-founder Larry Page, who owns 389 million Class B shares, will get a dividend payment of $78 million.

Investors have been looking for signs of maturity from technology firms. Every major technology firm announced layoffs and tightened spending beginning in 2022. Investors rewarded those efforts, and have shown a similar reaction to share buybacks and dividend initiations. When Meta announced its first ever dividend in February, it helped send shares soaring more than 14%.

Notably, Amazon has never issued a dividend, nor has it ever authorized a share buyback close to the size of Google’s. Amazon’s largest share repurchase, in 2022, was for up to $10 billion.

Amazon is slated to report first quarter earnings Tuesday.